federal tax abatement meaning

Tax abatement requirements can be modified. Tax Abatement Meaning Software Income Tax Calculator.

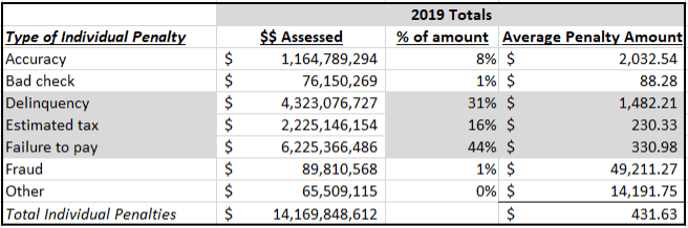

Irs Notice Cp215 Notice Of Penalty Charge H R Block

Tax returns IRC 6651 a 1.

. IRS Definition of IRS Penalty Abatement. The federal tax abatement reduces Part I tax payable. Tax abatement or a tax holiday means that a persons tax obligations are reduced by a certain amount.

Taxpayers use Form 843 to claim a. The lien protects the governments interest in all your property. Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate.

Tax Abatement Definition. Income earned outside Canada is not eligible for the federal tax abatement. On the federal level the critical abatement any accountant or bookkeeper should know is the federal tax abatement for corporations.

In other words when your taxes are. Tax Penalty Abatement Penalty abatement is a. Tax Abatement Meaning.

On line 608 enter the amount of federal tax. Failure to File when the penalty is applied to. Tax abatement is a kind of relief the IRS grants to taxpayers who exert effort to comply with the law but are unable to fulfill their tax obligations.

The federal tax abatement is equal to 10 of taxable income earned in the year in a Canadian province or territory. Penalties eligible for First Time Abate include. Income earned outside Canada is not eligible for the federal tax abatement.

Information about Form 843 Claim for Refund and Request for Abatement including recent updates related forms and instructions on how to file. A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt. The federal tax abatement reduces Part I tax payable.

The federal tax abatement is equal to 10 of taxable income earned in the year in a Canadian province or territory. Tax abatement requirements can be changed or can be modified. Property taxes represent a major expense for most homeowners typically amounting to 1 to 3 of the homes value each year.

This recurring expense doesnt go away. What is a tax abatement in Texas. Tax Penalty Abatement.

Most states or jurisdiction have their own rules and regulations. Reasons that qualify for relief due to reasonable cause depend on the type of penalty you owe and the laws in the Internal Revenue Code IRC for each penalty. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax.

Penalties Eligible for First Time Abate. This makes sense because the legal definition of abatement is a reduction suspension or cessation of a charge. As of 2017 that provides a flat 10.

The federal tax abatement reduces Part I tax payable.

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Tax Penalty Abatement Waiver Of Tax Penalties Help In California

What Is A Tax Abatement Smartasset

Irs Tax Penalties And The Tax Professional Reliance Defense Freeman Law Jdsupra

Philadelphia 10 Year Tax Abatement Changes What You Need To Know Nj Lenders Corp

Do S And Don Ts When Requesting Irs Penalty Abatement For Failure To File Or Pay Penalties Jackson Hewitt

/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)

Form 843 Claim For Refund And Request For Abatement Definition

What Is The 421g Tax Abatement In Nyc Hauseit

Property Tax Abatements How Do They Work

Solved Tmz Corporation Has Taxable Income Of 300 000 Of This Amount 90 Was Earned In Province What Is Tmz Corporation S Federal Tax Payable For Course Hero

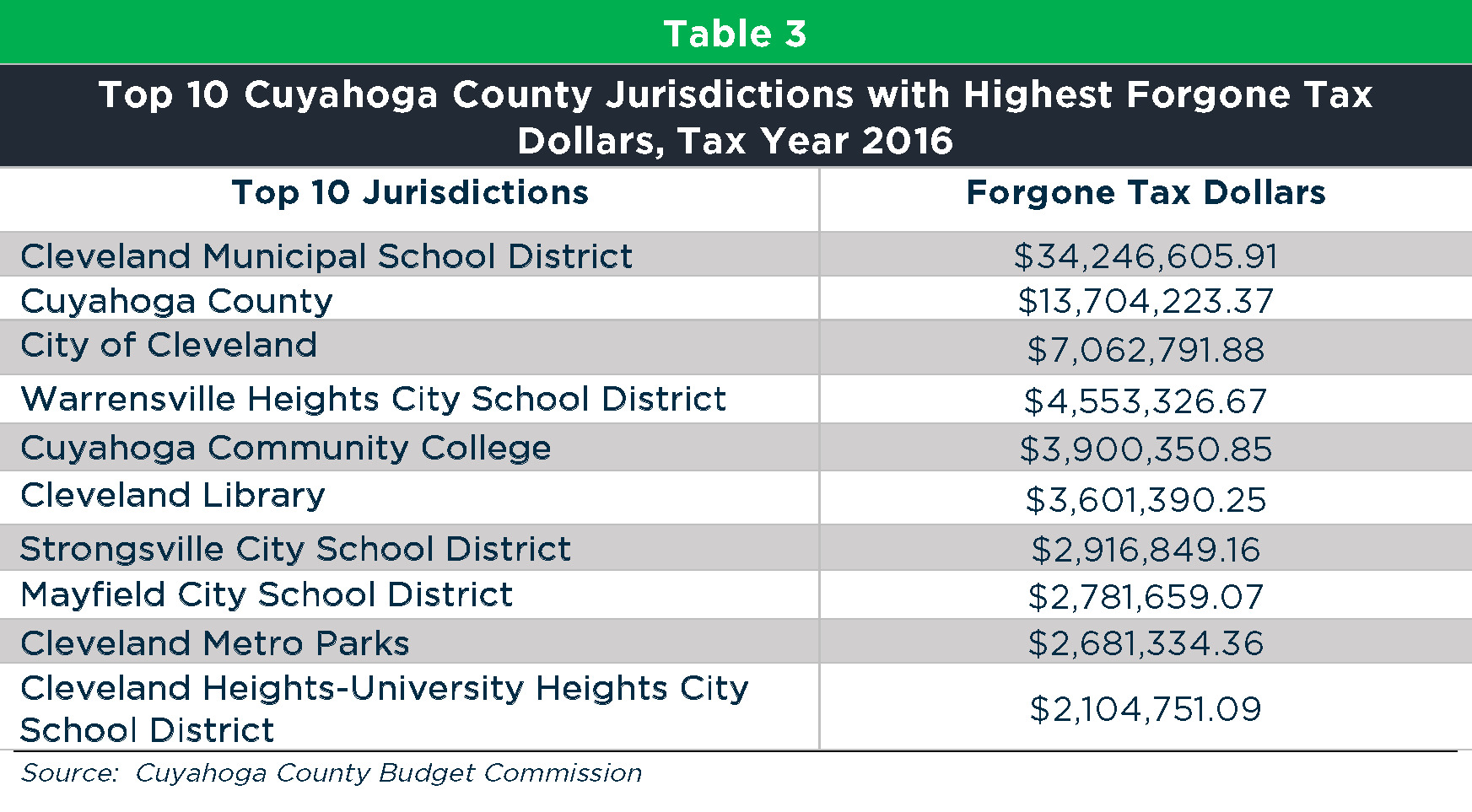

Local Tax Abatement In Ohio A Flash Of Transparency

Nyc Solar Property Tax Abatement Pta4 Explained 2022

Chapter 15 Taxable Income And Tax Payable For Corporations Ppt Download

4 Ny Solar Incentives For Homeowners Brooklyn Solarworks

Am I Eligible For Tax Abatement

What You Need To Know About Philadelphia S Tax Abatement Program The Legal Intelligencer

20 1 9 International Penalties Internal Revenue Service

How To Remove Irs Tax Penalties In 3 Easy Steps The Irs Penalty Abatement Guide Get Rid Of Tax Problems Stop Irs Collections